MicroStrategy, the business intelligence firm led by Michael Saylor, remains committed to its strategy of acquiring and holding Bitcoin, according to the recent company’s Q1 financial results. Despite the recent volatility in cryptocurrency markets, MicroStrategy plans to accumulate more Bitcoin with its excess cash and net proceeds from capital markets transactions.

Long-Term Bitcoin Investment Strategy

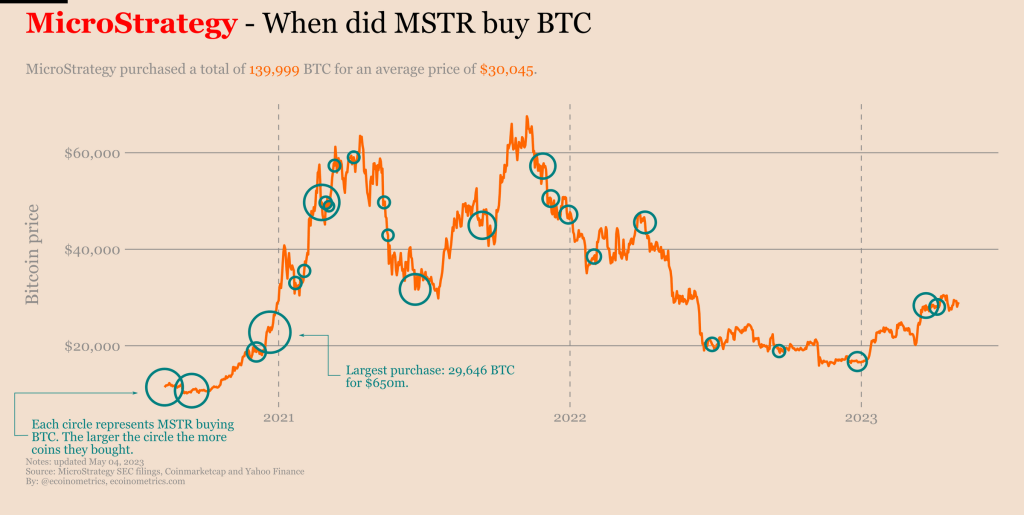

MicroStrategy is keeping a long-term, risk-managed approach to its Bitcoin strategy since 2020. The most recent purchase was for 1,045 Bitcoins last month. The company currently holds 140,000 Bitcoins with an aggregate cost of $4.2 billion or an average of approximately $29,800 per Bitcoin. This makes MicroStrategy the world’s largest publicly traded corporate holder of Bitcoin.

Reassuring Investors

Phong Le, CEO of MicroStrategy, reassured investors of the company’s financial health, noting the repayment of its $205 million Bitcoin-backed loan from Silvergate last year at a 22% discount. Following the repayment, MicroStrategy recovered 34,619 Bitcoins that were serving as collateral for the loan, which is now unencumbered. As of March 31, 2023, only 11% of MicroStrategy’s total Bitcoin holdings were pledged as collateral for debt.

Paying Board of Directors in Bitcoin

In addition to its Bitcoin investment strategy, MicroStrategy is paying its board of directors in Bitcoin instead of dollars. This move further underscores the company’s commitment to the cryptocurrency.

Controversy Surrounding MicroStrategy’s Bitcoin Investment

MicroStrategy’s decision to invest heavily in Bitcoin has been controversial, with some investors expressing concerns about the cryptocurrency’s volatility. However, Michael Saylor remains bullish on Bitcoin, arguing that it’s “100% better than gold” and is a hedge against inflation and a safe-haven asset during economic uncertainty.

MicroStrategy’s Bitcoin Stash

MicroStrategy’s bold investment has recently paid off handsomely, with the holdings increasing in value as the cryptocurrency’s price surged in recent months. According to ‘Saylor Tracker,’ a service that tracks MicroStrategy’s Bitcoin purchases, the firm’s Bitcoin stash value is currently at a loss of $203 million. Nonetheless, it remains to be seen whether Bitcoin prices can rise for those holdings to turn green.

Source: ZyCrypto

If you want to receive early daily news highlights, profitable trading signals and reports with cryptos with high earning potentials, sign up for CryptoChannel!