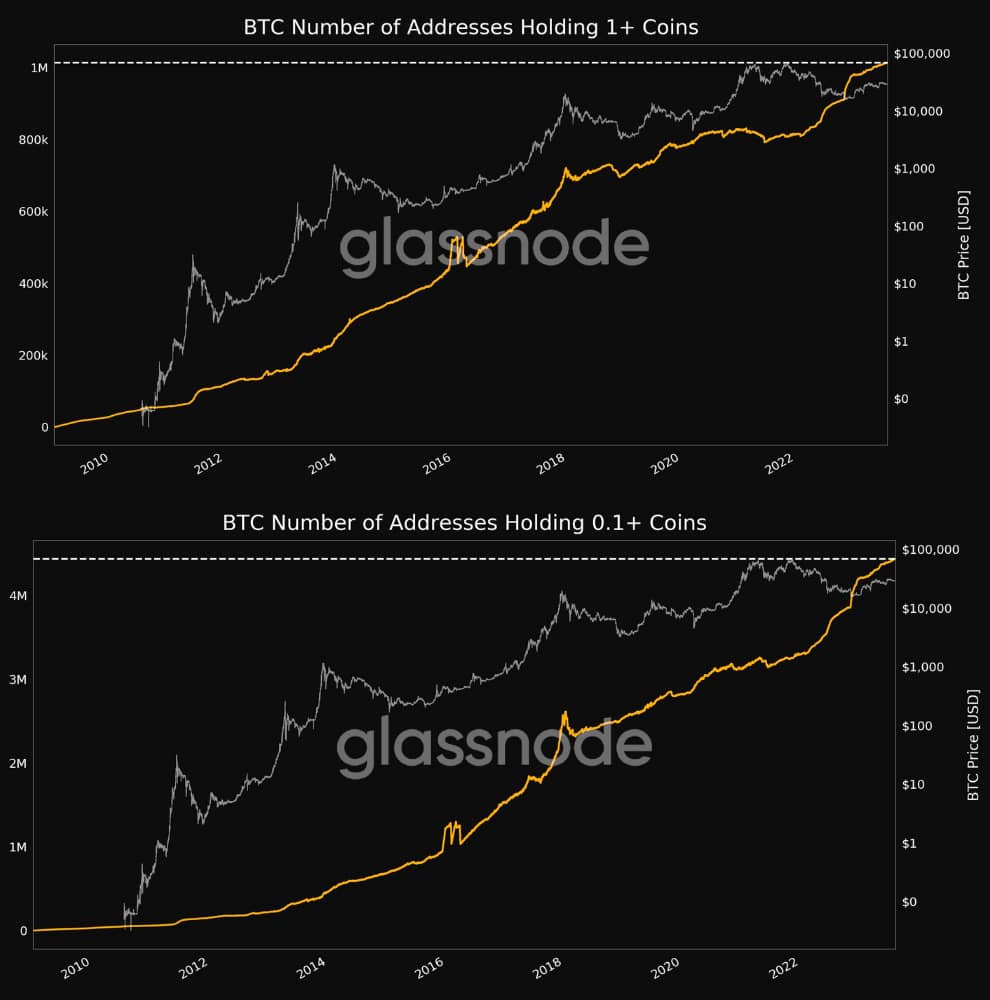

In a remarkable turn of events, the count of Bitcoin (BTC) addresses containing at least one unit of the cryptocurrency has skyrocketed to an unprecedented number of 1,013,414. This surge is primarily attributed to the mounting anticipation of a substantial price upswing in the realm of the leading digital currency.

Record-Breaking Bitcoin Holder Growth

Evidently, the expansion in the Bitcoin community is further exemplified by an additional milestone – the number of addresses with a minimum of 0.1 BTC has soared to a remarkable 4,436,238. This significant figure, validated by data from Glassnode on August 8th, marks the first instance of such an achievement in the chronicles of Bitcoin.

Interrelation of Bitcoin Holdings

It’s worth highlighting that these two numerical achievements are interconnected. The count of addresses with a solitary Bitcoin significantly influences the metric measuring addresses with holdings of 0.1 BTC or higher. A group of holders, collectively possessing more than $29,000 worth of Bitcoin, constitutes approximately 25% of the investors who hold at least $2,900 within the same wallet.

From a visual perspective, an interesting observation arises as the ‘Number of Addresses Holding BTC’ graph intersects with the ‘Bitcoin Price’ graph, both for the 1 BTC and 0.1 BTC populations.

Visualizing Bitcoin Population Trends

Visual representation of the Bitcoin population showcases the count of addresses containing 0.1 BTC and 1 BTC, sourced from Glassnode’s data.

Insights into Bitcoin Price Dynamics

Simultaneously, as of the time of writing, Bitcoin is being traded at a price point of $29,320. This reflects a modest 0.99% surge within the day, recuperating from the recent dip experienced on August 7th when the value plummeted below $28,800 per Bitcoin.

This price range has remained relatively stable since June 21st. With Bitcoin’s valuation fluctuating between $28,000 and $32,000, an auspicious opportunity emerges for bullish investors aiming to accumulate more coins. This trend is bolstered by insights from Glassnode’s data.

Factors Affecting Bitcoin’s Trajectory

In the grand scheme of things, the capacity of this digital asset to meet and exceed these expectations is contingent upon various developments tied to Bitcoin itself. Additionally, the prevailing sentiment in the broader crypto landscape and the macroeconomic environment will play pivotal roles in shaping Bitcoin’s trajectory.

As the cryptocurrency ecosystem evolves and macroeconomic conditions continue to shift, investors and enthusiasts alike remain watchful of Bitcoin’s journey, holding onto the hope of favorable outcomes. The ever-changing landscape of this digital realm introduces an element of excitement and unpredictability that keeps the global community engaged and invested.

The surge in the number of Bitcoin holders, both for the 1 BTC and 0.1 BTC categories, not only signifies growing interest but also underlines the potential for a significant price surge. The interconnectedness of these metrics and their alignment with price trends offer insights into the broader sentiment within the crypto market. As Bitcoin maintains its range-bound price movement, opportunities arise for strategic accumulation, all while the digital asset’s future trajectory hinges on a myriad of internal and external factors.

Source: Finbold

If you want to receive early daily news highlights, profitable trading signals and reports with cryptos with high earning potentials, sign up for CryptoChannel!