In a groundbreaking development, the verdict has been reached in the highly publicized legal battle between Grayscale and the SEC concerning the Bitcoin Spot ETF.

Grayscale’s Legal Victory

The momentous decision has come down, and it’s in favor of Grayscale. The court has ruled in favor of Grayscale in its lawsuit against the SEC, bringing this high-stakes dispute to a resounding conclusion.

Commission’s Decision Nullified

The court’s judgment has invalidated the SEC’s earlier decision. Grayscale’s request for review has been accepted, marking a significant turning point in this legal saga.

Appeals Court Rebukes SEC

A US federal appeals court has unequivocally declared that the SEC was wrong in rejecting Grayscale’s spot Bitcoin ETF application. The court’s decision underscores a crucial point: the SEC’s rejection of Grayscale’s proposal was both arbitrary and unlawful. The SEC’s failure to provide a clear rationale for treating similar products differently was a key factor in the court’s decision.

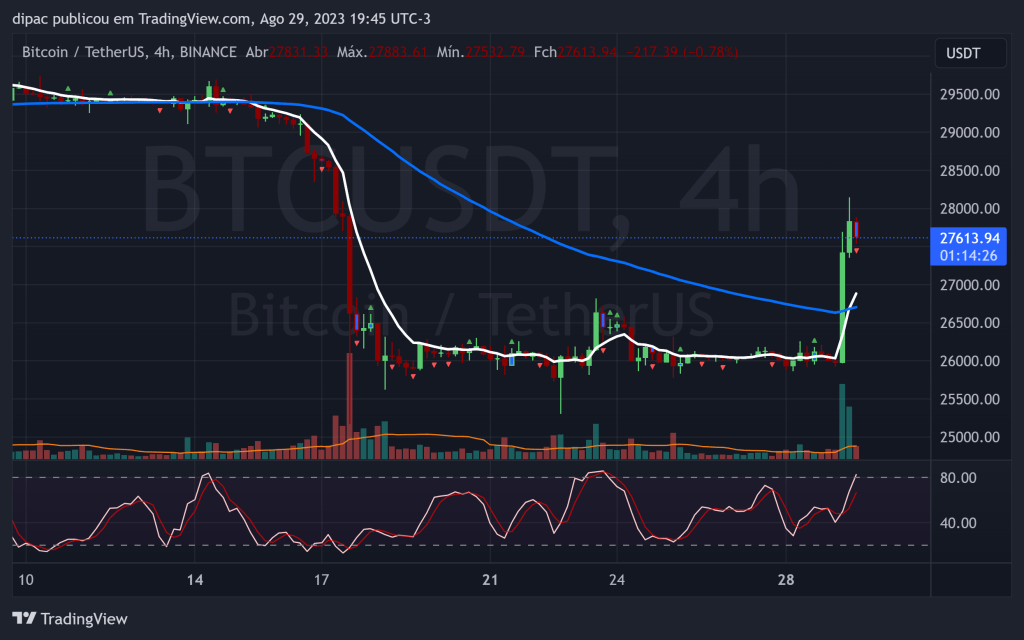

Bitcoin’s Reaction to the Verdict

Following the court’s ruling, Bitcoin has surged by 5.7%, reaching $27,600. This dramatic price movement reflects the market’s reaction to the court’s decision, which found fault with the SEC’s rejection of Grayscale’s spot Bitcoin ETF application.

Industry-Wide Attention

This legal battle has been closely monitored by both the cryptocurrency and asset management industries. These sectors have long sought the SEC’s approval for a spot Bitcoin ETF, believing it would provide investors with exposure to the cryptocurrency market without requiring direct ownership of Bitcoin itself. In contrast, the SEC has expressed concerns that spot BTC ETFs could be susceptible to manipulation.

SEC’s Previous Actions

It’s worth noting that the SEC had previously rejected Grayscale’s bid to transform its Grayscale Bitcoin Trust into an ETF. While the SEC declined spot Bitcoin ETFs, it approved Bitcoin futures ETFs that track agreements to buy or sell Bitcoin at pre-agreed prices. Grayscale had proposed implementing similar safeguards against manipulation as those approved for futures ETFs, but the SEC contended that it did not meet their standards.

Grayscale’s Legal Challenge

Unlike other asset management companies, Grayscale took the bold step of suing the SEC. This case bypassed lower courts and proceeded directly to the appellate court due to the SEC’s status as a regulatory agency.

Grayscale’s Argument

Grayscale’s argument hinged on the belief that the surveillance arrangements for Bitcoin futures ETFs should be deemed satisfactory for a Grayscale spot ETF as both products are fundamentally based on Bitcoin’s underlying price.

Contrasting Views on Surveillance

Bitcoin futures ETFs track BTC futures traded on the Chicago Mercantile Exchange (CME), the primary marketplace for such products. The SEC maintained that the CME effectively “monitors futures market conditions and price movements in real time and continuously to detect and prevent price distortions, including price distortions caused by manipulative efforts.”

Grayscale’s Position

Donald Verrilli Jr., Grayscale’s chief attorney, argued before the court in March that a spot Bitcoin ETF would “better protect investors” by leveraging the CME’s market surveillance.

SEC’s Data Concern

However, the SEC countered that it lacked sufficient data to determine whether Grayscale’s CME futures surveillance arrangement could effectively detect potential manipulation in the spot markets.

The Next Steps

Both parties have a 45-day window to appeal the decision. If an appeal is pursued, it could lead to the case being elevated to the US Supreme Court or undergo an en banc panel review. Grayscale’s CEO has already expressed readiness to appeal if the court’s decision favors the SEC.

Potential Outcomes

In the event that Grayscale prevails, and the SEC chooses not to appeal, the court will determine the appropriate course of action. This could entail instructing the SEC to approve or reconsider Grayscale’s application, or the SEC may reject the proposal on alternative grounds.

Grayscale’s Perspective

Grayscale has hailed the court’s decision as a monumental stride forward for American investors and the broader Bitcoin ecosystem. This legal victory holds significant implications for the cryptocurrency market and underscores the ongoing evolution of regulatory oversight in the digital asset space.

Source: BitcoinSistemi

If you want to receive early daily news highlights, profitable trading signals and reports with cryptos with high earning potentials, sign up for CryptoChannel!